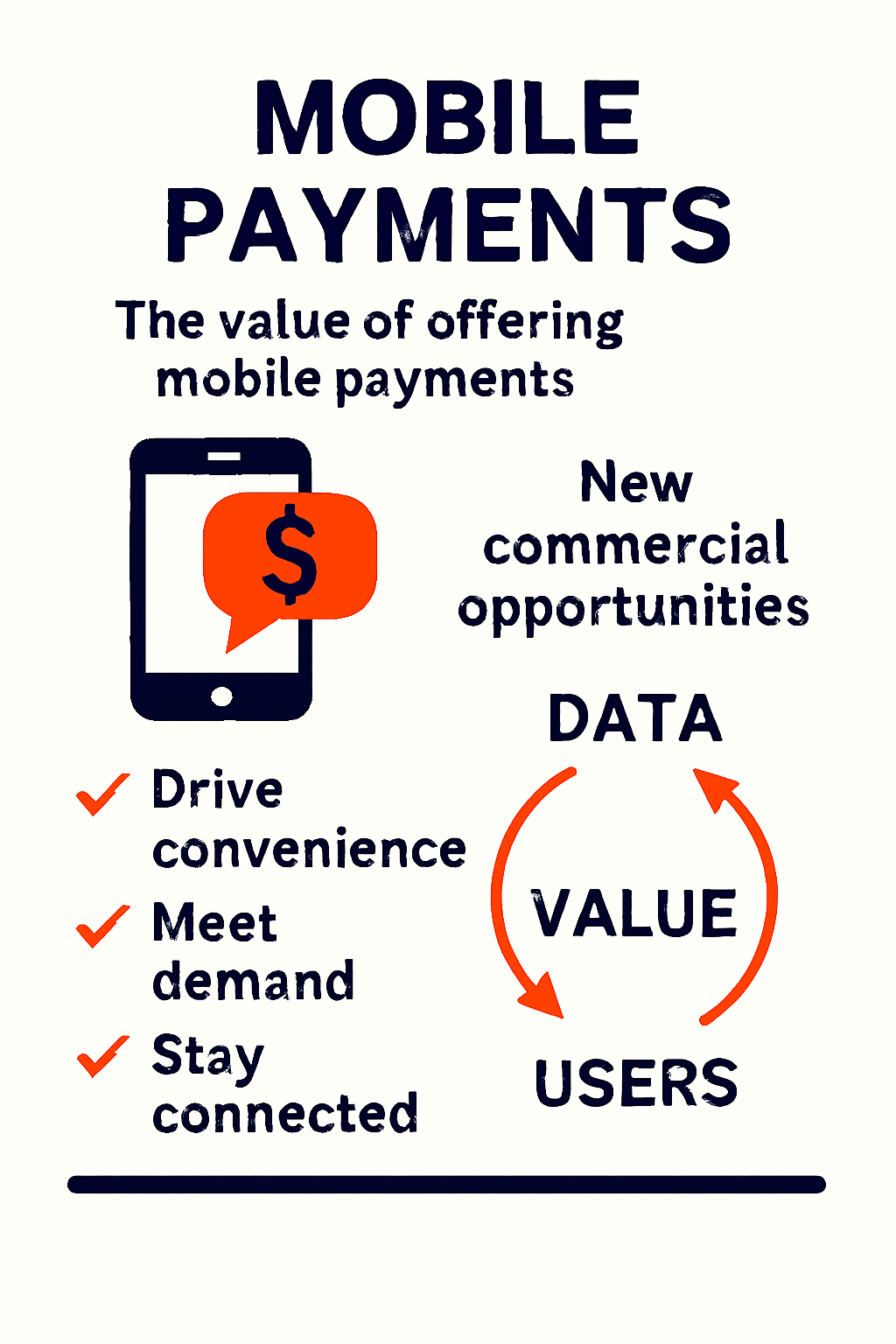

Unlocking convenience, connection, and commercial opportunity

Not long ago, mobile phones were limited to calls and texts. Today, smartphones have become financial tools – enabling seamless transactions, banking, and purchases from virtually anywhere.

This shift has transformed consumer behavior. Data shows that mobile payments are now mainstream, with users increasingly relying on their devices to manage money on the go.

A New Era of Mobile Commerce

Apps like PayPal have redefined the mobile payment experience.

Their redesigned platform now offers:

- Location-based deals and promotions

- “Order ahead” functionality to skip queues

- Bill payment without server interaction

- Direct credit lines with local merchant, bypassing traditional card networks

These features don’t just enhance convenience – they create new pathways for engagement and loyalty.

Why It Matters for Business

For emerging businesses, mobile payments represent more than a tech upgrade—they’re a strategic opportunity to:

- Simplify the customer experience

- Increase transaction speed

- Reduce reliance on legacy payment systems

- Tap into location-based marketing and loyalty programs

Mobile payment functionality can be a competitive differentiator, especially for businesses looking to scale quickly and meet consumers where they are – on their phones.

Final Thought

Mobile payments aren’t just a trend – they’re a shift in how commerce happens. For businesses ready to embrace it, the rewards are clear: greater reach, faster transactions, and deeper customer connection.